20/10/2020

Contents:

According to analysts, CURO Group's stock has a predicted upside of 8.11% based on their 12-month price targets. Analysts like CURO Group less than other Finance companies. The consensus rating score for CURO Group is 2.00 while the average consensus rating score for finance companies is 2.43. Dividend yield allows investors, particularly those interested in dividend-paying stocks, to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price. According to analysts' consensus price target of $4.00, CURO Group has a forecasted upside of 154.0% from its current price of $1.58.

Real-time analyst ratings, insider transactions, earnings data, and more. Moody’s Daily Credit Risk Score is a 1-10 score of a company’s credit risk, based on an analysis of the firm’s balance sheet and inputs from the stock market. The score provides a forward-looking, one-year measure of credit risk, https://day-trading.info/ allowing investors to make better decisions and streamline their work ow. Updated daily, it takes into account day-to-day movements in market value compared to a company’s liability structure. We sell different types of products and services to both investment professionals and individual investors.

The company issued 6,700,000 shares at $14.00-$16.00 per share. Credit Suisse, Jefferies and Stephens acted as the underwriters for the IPO and William Blair and Janney Montgomery Scott were co-managers. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. fx broker questiion;tickmill, darwinex, ic markets or pfd nz There's a lot to be optimistic about in the Financial sector as 2 analysts just weighed in on Brown & Brown (BRO – Research Report) and Curo Group Holdings (CURO – Research Report) with bullish sentiments. Data are provided 'as is' for informational purposes only and are not intended for trading purposes.

CURO Group Holdings Corp., together with its subsidiaries, provides consumer finance products in the United States and Canada. It operates under the Covington Credit, Heights Finance, Quick Credit, Southern Finance, First Heritage Credit, Cash Money, LendDirect, and Flexiti brands. The company was formerly known as Speedy Group Holdings Corp. and changed its name to CURO Group Holdings Corp. in May 2016. CURO Group Holdings Corp. was founded in 1997 and is headquartered in Chicago, Illinois. 3 brokers have issued 1 year target prices for CURO Group's shares. Their CURO share price forecasts range from $4.00 to $4.00.

Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time. We’d like to share more about how we work and what drives our day-to-day business. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

(9.76%), HighTower Advisors LLC (0.92%), Morgan Stanley (0.57%), Charles Schwab Investment Management Inc. (0.37%), Dimensional Fund Advisors LP (0.33%) and Millennium Management LLC (0.31%). Insiders that own company stock include Chadwick Heath Faulkner, Donald Gayhardt, Douglas D Clark, Ffl Partners, Llc, Fleischer & Lowe Gp I Friedman, Michael Mcknight and William C Baker. The company is scheduled to release its next quarterly earnings announcement on Monday, May 1st 2023. A high percentage of insider ownership can be a sign of company health. CURO Group has a short interest ratio ("days to cover") of 5.5.

CompareCURO’s historical performanceagainst its industry peers and the overall market. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated.

CURO Group has only been the subject of 1 research reports in the past 90 days. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. TORONTO----Flexiti Financial Inc. (“Flexiti”), a leading point-of-sale consumer financing solution for retailers, has announced today that it has upsized its revolving warehouse credit ... CURO Group has been rated by Credit Suisse Group in the past 90 days. Sign-up to receive the latest news and ratings for CURO and its competitors with MarketBeat's FREE daily newsletter.

Approximately 3.5% of the company's stock are sold short. Market capitalization is calculated by taking a company’s share price and multiplying it by the total number of shares. In the Morningstar Style Box, large-cap names account for the largest 70% of U.S. stocks, mid-cap names account for the largest 70–90%, and small-cap names are the remaining 10% of companies. The chart below shows how a company's share price and consensus price target have changed over time.

A staggering $226 BILLION is earmarked for projects requiring huge amounts of copper. Turns out, copper is a desperately needed mineral to power the green revolution of clean, renewable energy. Only 1 people have added CURO Group to their MarketBeat watchlist in the last 30 days. This is a decrease of -50% compared to the previous 30 days.

These are established companies that reliably pay dividends. Money Flow Uptick/Downtick RatioMoney flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an "uptick" in price and the value of trades made on a "downtick" in price. The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades. Net money flow is the value of uptick trades minus the value of downtick trades. Our calculations are based on comprehensive, delayed quotes.

CURO Group saw a increase in short interest in the month of February. As of February 15th, there was short interest totaling 693,400 shares, an increase of 12.7% from the January 31st total of 615,200 shares. Based on an average daily trading volume, of 117,200 shares, the days-to-cover ratio is presently 5.9 days.

Market Cap is calculated by multiplying the number of shares outstanding by the stock's price. To calculate, start with total shares outstanding and subtract the number of restricted shares. Restricted stock typically is that issued to company insiders with limits on when it may be traded.Dividend YieldA company's dividend expressed as a percentage of its current stock price. 3 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for CURO Group in the last twelve months.

CURO Group announced a quarterly dividend on Tuesday, August 9th. Shareholders of record on Monday, August 15th will be paid a dividend of $0.11 per share on Friday, August 26th. This represents a $0.44 annualized dividend and a dividend yield of 27.85%. The ex-dividend date of this dividend is Friday, August 12th. In the past three months, CURO Group insiders have bought more of their company's stock than they have sold. Specifically, they have bought $210,800.00 in company stock and sold $0.00 in company stock.

TORONTO----Flexiti Financial Inc. (“Flexiti”), a leading point-of-sale consumer financing solution for retailers, is pleased to announce that the company has reached $2 billion in lifet... TORONTO----Flexiti Financial Inc. (“Flexiti”), a leading point-of-sale consumer financing solution for retailers, is pleased to announce that the company has reached C$1 billion in lo... Curo Group doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. You do not have an alert portfolio, please create one here. NA1.27Lodge Hill Capital LLC1.20Shareholder percentage totals can add to more than 100% because some holders are included in the free float.

Consensus forecasts are supplied by third party analysts and calculated by our data feed providers. As the forecast is completely dependent on updates received, not all companies' consensus forecasts are updated regularly. Online lender Curo Group Holdings Corp. said Thursday it has priced its initial public offering at $14 a share. The company sold 6.7 million shares to raise $93.8 million. Provide specific products and services to you, such as portfolio management or data aggregation.

Over the previous 90 days, CURO Group's stock had 1 downgrade by analysts. Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart's disclaimer. Raised $100 million in an initial public offering on Thursday, December 7th 2017.

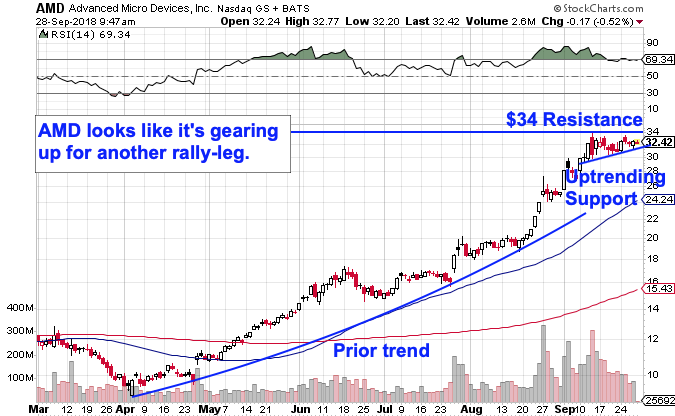

Note increase in volume on Friday, September 21 as well as MACD cross-over. CURO looks like it is about to break out of bullish consolidation. TORONTO----Flexiti Financial Inc. (“Flexiti”), a leading provider of point-of-sale consumer financing solutions for retailers, announced today that is has launched its omni-channel cust...

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes.

Intraday data delayed at least 15 minutes or per exchange requirements. High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks.

(11%) has been stable over the past year, but is still higher than 75% of US stocks. One share of CURO stock can currently be purchased for approximately $1.58. A $226B Copper Spending JackpotOn November 15, 2021, President Biden signed the biggest infrastructure spending bill of all time.

On average, they predict the company's stock price to reach $4.00 in the next year. This suggests a possible upside of 153.2% from the stock's current price. View analysts price targets for CURO or view top-rated stocks among Wall Street analysts. According to the issued ratings of 3 analysts in the last year, the consensus rating for CURO Group stock is Hold based on the current 1 sell rating, 1 hold rating and 1 buy rating for CURO. The average twelve-month price prediction for CURO Group is $4.00 with a high price target of $4.00 and a low price target of $4.00.

Powered by WhatsApp Chat